Scams are part of life these days with new ones popping up all the time. While many might wish for a simpler time when people weren’t taken advantage of, that time apparently has never existed. Con artists have been abusing the trust of friends, acquaintances and unassuming passersby for decades, if not centuries, so there’s no reason to think that we’ll ever stop it from happening. What we can do though, is become educated on the latest scams and the added twists that technology is playing in their execution.

Northumberland OPP Constable James Clarke is currently touring the County educating residents about the most common scams running which include a shopping list of cons that include the “Grandparent/Emergency” scam, “Romance” scam, “CRA” scam, “Service” scam, “Overpayment” scam, “Health” scam and a “Roadside” scam which has become more prevalent in our region.

Constable Clarke told us more about the roadside scam.

Clarke says that seniors appear to be more susceptible to fraud than any other segment of the population, perhaps because they are more isolated, have health or memory issues, are less likely to end a conversation or they come from a generation that is just more trusting in general.

In 2019, the estimated losses associated with fraud as reported by the Canada Anti-Fraud Centre were in the neighbourhood of $130 million, with $160 million lost in 2020 and nearly $400 million dollars in 2021. In 2022, the number had rose to half a billion and that’s just the reported incidences. Clarke says only 5-10% of these crimes get reported, so factor $500 million by 10 and you get $5 billion lost to fraudsters in 2022 in a trend that is alarmingly on the rise.

One scam that many have become familiar with is the Grandparent or Emergency scam. Someone calls claiming to be or represent a loved one in need of money for bail or they’ve had an accident. Victims are instructed to send money via a wire transfer or leave money nearby to be collected. It may sound crazy to leave five thousand dollars in a garbage can, but scammers can be incredibly convincing.

Clarke told us you can foil this scam by having a conversation now with your loved ones.

Remember, it’s your money they’re trying to get at and you have the right to ask questions and expect answers. When a scammer fails to provide you the correct password, they’ll be unmasked and will often just give up.

Clarke said you should also check with the loved one named to see if they’re okay or with the authorities to see if your loved one is actually in trouble.

With Valentines Day just around the corner, a rise in romance scams is expected, though these type of cons happen all year long. Constable Clarke says, though it may be flattering, be careful of those who profess to have fallen head over heals for you in a matter of days.

Red flags include requests for a loan to help our their struggling business or for money to pay for a treatment of a health condition. This type of fraudster will also ask to take conversations offline to maintain secrecy and protect their identity while at the same time getting more personal information that they can use to separate you from your hard earned cash.

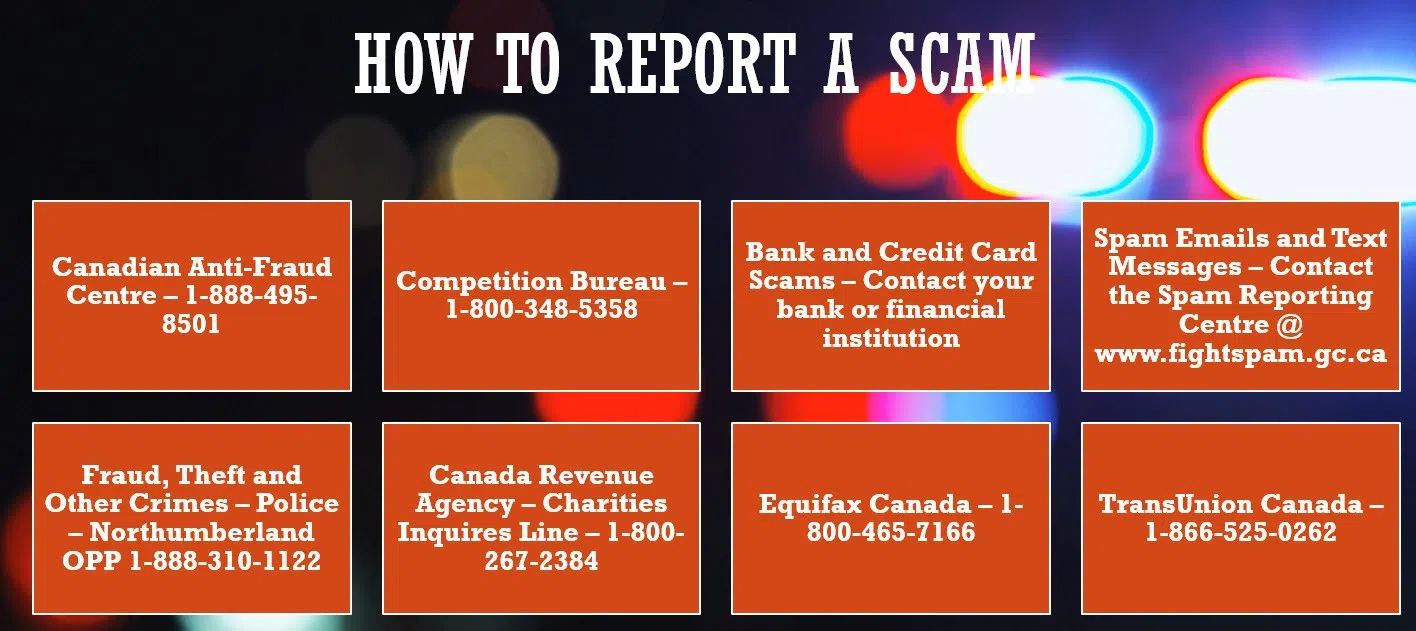

Clarke says that your best defense against scammers is to be educated. A couple of great resources for that are the Government of Canada’s “Little Black Book of Scams” website (The Little Black Book of Scams (canada.ca)) where you can learn more about scams that are taking place right now and the Canadian Anti-Fraud Centre website (Canadian Anti-Fraud Centre (antifraudcentre-centreantifraude.ca)) where you can report scams and learn how to protect yourself.

James told us one of the up and coming scams they’re concerned about involves artificial intelligence which, with a sample from a video, can mimic the voice of friends and loved ones. On the other side of the technology coin, A.I. is one of the most powerful tools authorities are using to stop fraudsters. For now, just be aware of where you’re leaving your “digital footprint” online with videos, recordings as they could be used to by fraudsters in the future scams.

If you think you’ve been a victim of a scam, you can also reach out to the OPP at 1 888 310-1122.

(Written by: Joseph Goden)