A unanimous Brighton council has thrown its support behind a $61.7-million budget for 2025, with a 7.61 per cent municipal levy increase, according to the latest figures available from the municipality.

However, that hike is anticipated to drop some after factoring in growth and in terms of the impact to the average residential taxpayer, with municipal staff projecting a blended increase at about 6.24 per cent.

Like with most municipalities, balancing growing needs, affordability and tackling infrastructure gaps continues to be a growing challenge amid inflation and other pressures, particularly in more recent years.

“We need to continue to move projects forward – pay for the loans for the larger projects – and you know, none of these things come without a considerable price tag – (or) a considerably larger price tag than they did yesterday at the end of the day,” notes Mayor Brian Ostrander.

Council gave the budget the OK following a public budget meeting earlier this week; however, the budget bylaw still needs to be ratified and is slated to return to council on March 3.

Overall, figures this year are up in comparison to last year’s roughly $35-million budget.

According to municipal staff, this is largely due to several bigger capital projects, such as construction of a new fire hall and paramedic base and an upgraded wastewater treatment facility, as just two examples.

However, CAO Elana Arthurs also says the increase is offset by revenues – much of that including grant funding – therefore, “keeping the overall impact relatively low.” (As previously reported, the province also earlier this year announced a historic $35-million investment that will help with a new wastewater treatment facility and unlock new housing at the same time.)

According to budget documentation, revenue has more than doubled since last year’s budget – $48.2 million versus $23.2 million. Put another way, the tax levy in 2024 was roughly $12.2 million and this year is coming in at $13.5 million; equating to a budget increase of about $1.3 million.

After factoring in 2024 growth at $320,423, the tax increase comes out to $984,009 – this is the dollar amount officials say is needed to maintain and enhance services and advance critical projects.

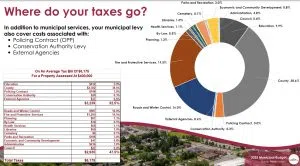

Arthurs recently walked the public through the budget process, explaining more about how the blended rate is calculated and where your tax dollars ultimately go.

Arthurs notes that calculating the levy is difficult, but in short, the blended rate components – the education levy at zero per cent, the county levy at 6.12 per cent and the municipal levy combined – create that blended rate; and those amounts are then multiplied by the tax rate, translating to an overall 6.38 per cent increase, then the “weighted value” gets to the 6.24 per cent residential hike.

Translation?

“The impact on a $400,000 home, right now, you’re looking at $6,174.51,” says Arthurs. (Of note: This scenario is based on an MPAC assessment of $400,000.)

Arthurs elaborates more on the roles in the overarching tax rate process.

A CLOSER LOOK AT BUDGET NUMBERS

Budget documentation indicates the proposed 2025 expenditures total $61,746,217.

Numbers are down from the start of Brighton’s budget process, with the initial draft in January proposing a 7.67 per cent hike – the subsequent addition of 1.5 per cent worth of grants-in-aid would’ve pushed this figure to 9.13 per cent. Following this, staff were directed to drill down further on figures to find savings and ways to decrease tax impacts.

In terms of municipal tax comparisons between neighbouring Northumberland communities, Brighton continues to sit in the middle of the pack for the last two years. Last year, that $6,174.51 tax impact was roughly $5,812, meaning taxes, on average, are going up $362.55, according to municipal staff.

The overall range in the comparison for tax impacts goes from $7,454 at the highest in urban Port Hope, to $5,156 in the Township of Hamilton.

WHAT’S DRIVING COSTS?

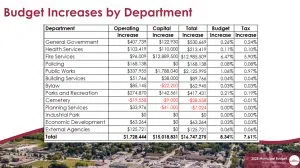

Environmental services lead the charge for overall total expenditures at $23 million (as well as in capital expenditures with $19.9 million.) Public works ($11.8M) and fire services ($14.4M) in the overall analysis also take up a good chunk of the pie. Of course, other departments and areas such as general government services, policing, external budgets, health services, parks and recreation, et cetera, are also seeing challenges and increases.

Under operating expenditures, the biggest chunk of the pie goes to public works ($5.2M) followed by environmental services ($3M), then general government ($2.8M), and policing ($2.1M), and so on. Fire services need another $1.2 million here, and external agencies alone have surpassed $1 million.

Meanwhile, the bulk of capital expenditures is again attributed to environmental and fire services and public works. There are also modest slices carved out for general government, bylaw and other departments.

Approximately $20.3 million is allocated in the operating budget, while about $41.3 million is assigned to the capital budget.

In other words, among the pressures identified in this budget cycle include increases to external budgets – the conservation authority, policing, Quinte Transit and the Brighton Public Library – along with climbing costs under internal strains related to ongoing service delivery, insurance, staffing and training, and more. However, the phased-in approach for OPP costs was considered a win.

Under user-supported water and wastewater budgets, water budget expenditures are down from last year, at roughly $5.5 million (with revenue translating to the same.) But under the wastewater budgets, expenditures are up to approximately $17.4 million versus $5.2 million last year (again, revenues equal out.)

Additional total tax supported revenue is detailed at $38.7 million for 2025.

WHAT PROJECTS ARE IN THE WORKS?

Ostrander tells us about some of the big-ticket projects lined up to get started this year.

This is a three-year project that started last year.

Ostrander called it a huge undertaking and also notes that there will be more work on a portion of Harbour Street, and one of the smaller connected residential streets.

“We also recognize the need to continue work on our rural roads, and so there’s another half-dozen or so rural roads that will be reconstructed and/(or) resurfaced this year as well.”

“And you know, this doesn’t take away the need to replace our sewage treatment plant, which is a project that will start to get underway this year, too,” notes Ostrander.

In addition to these two massive ventures, there is construction of the new fire/paramedic station, as well as upgrades to Fire Station #2. (The new base is another shared project with the county.)

But these aren’t the only projects or concerns to tackle in the community, says Ostrander.

With hopes of helping amid a raging housing crisis, Brighton has undertaken a land banking program and purchased “a large chunk of property to the east of No Frills,” shares Ostrander, adding the idea is to make this an affordable neighbourhood – a place where people can live in relative affordability. The property is just north of the tracks and east of John Street, so “sandwiched between the tracks and Hwy. 2.”

Ostrander tells us what’s next.

In addition to monies set aside to advance Brighton’s land banking development plan and servicing design, there are also plans for a related business and marketing plan.

In terms of other budget highlights, residents can expect the creation of a centralized customer service desk for all departments at the Municipal Centre, renovations at 67 Sharp Rd., the demolition of 21 Kingsley Ave., and investments in equipment, such as an electric pick-up truck and other vehicles like tandem trucks, et cetera. Monies have also been allocated for a culvert study and structural evaluation on White’s Road.

Work will continue on a multi-purpose recreation facility development study and business plan, arena upgrades, the Walas Street Park project, trail construction and renovation, and more under parks and rec. Safety fencing for King Edward Park is also coming.

Council also earlier OK’d grants for some 19 area organizations, charities, service groups, and more. A few of the recipients include the Trenton Memorial Hospital Foundation, Rainbow Youth Centre, Beacon Youth Centre, Codrington Farmers’ Market, Brighton Arts and Culture Council, the curling club, and others. A grant for University Hospitals Kingston Foundation will also honour former Coun. Byron Faretis, who passed away last year after a short but courageous battle with cancer.

Partnerships will also continue with boards and agencies such as Downtown Brighton, the Bay of Quinte Economic Development Commission, Docs by the Bay, and others.

Ostrander says council has also added to physician retention efforts, OK’d a rain barrel program, and added to the community improvement plan (CIP) to help downtown businesses access funding and/or defer tax payments to tackle areas like making entranceways more accessible. All of this is ultimately about trying to make Brighton a more livable community, he says.

(Written by: Sarah Hyatt)